The Limited Liability Partnership (LLP) structure has become a popular choice for businesses seeking the benefits of both a partnership and a limited company. However, like any registered entity, LLPs are subject to statutory filing obligations with the relevant government authorities. Among these, LLP Form 11 stands out as a crucial annual compliance document. Understanding the intricacies of Form 11, including its filing requirements, strict timelines, and the increasingly streamlined online procedure, is paramount for every LLP to maintain good standing and avoid penalties.

Failure to file LLP Form 11 accurately and on time can lead to significant consequences, including hefty fines and even the striking off of the LLP from the register. This document serves as a vital annual statement of accounts and confirms the LLP's continued operational status. This article will demystify the process, providing a clear roadmap for LLPs to navigate the requirements of LLP Form 11 with confidence, ensuring seamless compliance and operational continuity.

Understanding LLP Form 11: Purpose and Importance

LLP Form 11 is a key annual declaration. Its main purpose is to confirm an LLP's financial status and ongoing operation each year. This helps keep track of all registered businesses.

What is Form 11?

LLP Form 11 is an annual return form. It tells the government about your LLP's partners and its overall status. You must provide certain facts about your business.

Key information included covers your LLP's name and its registration number. You also state the accounting period this report covers. The form asks for a brief statement of accounts. You must confirm your registered office address too. Details of all partners are also a must.

Why is Filing Form 11 Mandatory?

Filing Form 11 is a legal duty for all LLPs. It's not an option; it's a requirement set by law. This obligation ensures your business stays legal and active.

This form helps with transparency and accountability in the business world. It allows the regulatory body to see key details about your LLP each year. Non-compliance brings serious trouble. You face financial penalties and late fees. There's even a risk your LLP could be dissolved and removed from the register.

Key Filing Requirements for LLP Form 11

All registered LLPs must file Form 11 each year. This rule applies no matter the size of your business or how much money you make. You need to gather certain documents and information before you start.

It's very important that all the data you submit is correct and up-to-date. Any wrong information can cause delays or bigger problems. Double-check everything carefully.

Annual Accounts and Statements

You must prepare annual accounts for your LLP. The accounting period for Form 11 usually ends on March 31st each year. This period dictates the financial data you report.

Your financial statements include a balance sheet and a profit and loss account. These documents give a clear picture of your LLP's money situation. Larger LLPs might need an audit of their accounts. Smaller LLPs often do not need one, but they still must prepare their financial data properly.

Partner Information and Changes

Form 11 requires you to list all current partners. You must provide their basic details, such as names and partner identification numbers. This information helps keep track of who is part of the LLP.

If any partners joined or left during the financial year, you must report these changes. This ensures the records are current. Designated partners hold a key role. They are responsible for making sure all filing duties, including Form 11, are met on time.

LLP Form 11 Filing Timelines and Deadlines

The general deadline for filing LLP Form 11 is October 30th each year. This date applies for the financial year ending on March 31st of the same year. Missing this deadline can lead to fines.

In some cases, you might be able to get an extension. However, this is not always simple and requires proper reasons. The end of your LLP's accounting period directly impacts your filing deadline. Your forms are due a certain number of days after your financial year closes.

Calculating the Deadline

You calculate the due date from your accounting period end. For example, if your financial year ends on March 31st, your LLP Form 11 filing deadline is October 30th of the same year. This gives you time to prepare everything.

For a new LLP, the first-year filing rules might be different. Always check the specific rules for new registrations. Set reminders on your calendar for these key dates. This helps you stay organized and avoid last-minute stress.

Consequences of Late Filing

Late filing of Form 11 comes with clear financial penalties. Each day you are late can add to the fine amount. These fees can quickly add up, becoming very expensive.

Beyond money, there are other legal problems. Your LLP might lose its "active" status. The regulatory body could even start steps to close down your business. Non-compliance can also harm your LLP's reputation. Future partners or lenders might see your business as unreliable.

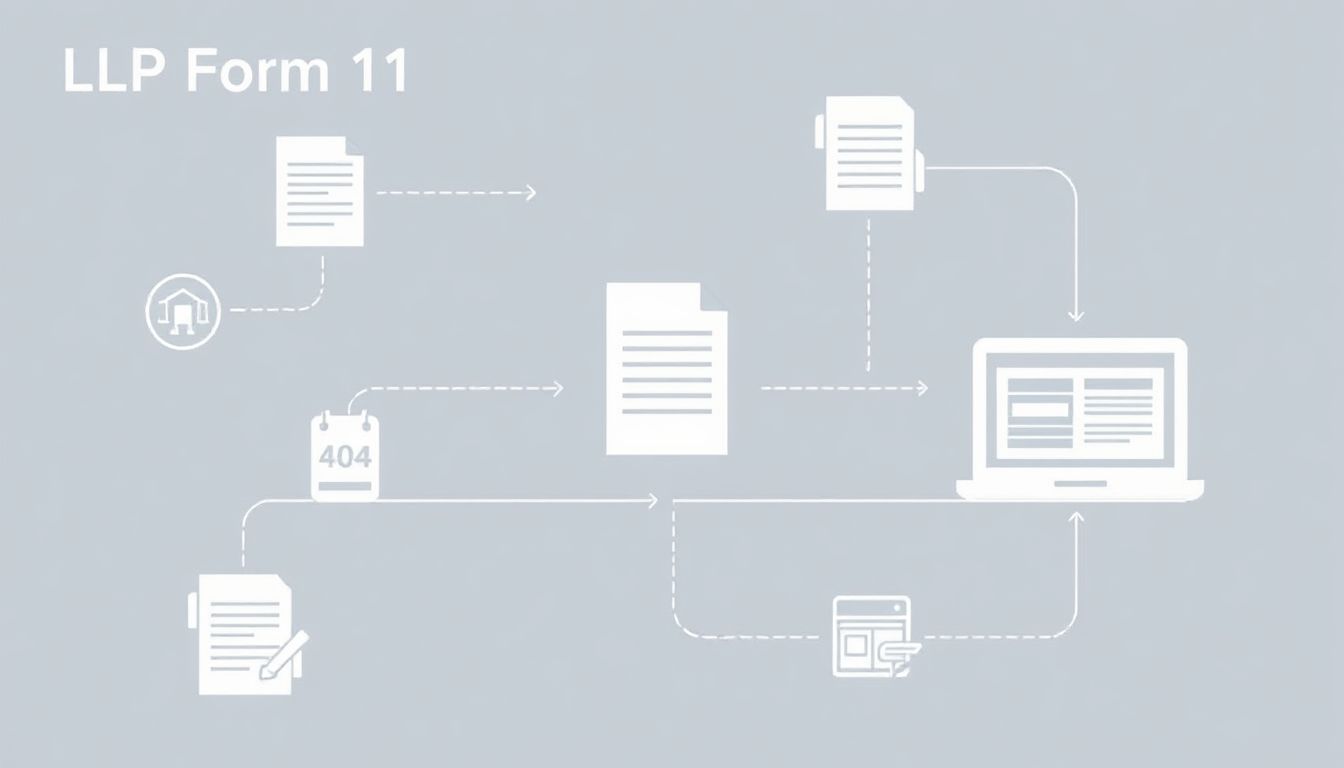

The Online Procedure for Filing LLP Form 11

Most government bodies now offer an online platform for filing LLP Form 11. This e-filing portal makes the process quicker and more efficient. You will need to set up an account and have proper login details ready.

The online procedure is designed to guide you step-by-step. This digital method saves time and reduces paper use. Always use the official government website for filing.

Navigating the E-Filing Portal

First, log in to the specific government portal for LLP filings. Find the section for annual returns or LLP forms. From there, you can locate and begin filling out Form 11. The site is usually user-friendly.

The data entry interface guides you on where to input information. Fields are clearly marked for your LLP's details, financial figures, and partner information. Take your time to fill in each section accurately.

Uploading Documents and Submitting

The online system allows you to upload necessary documents. Make sure your files are in acceptable formats, like PDF. Check for specific guidelines on naming or structuring these attached files.

You will also pay any filing fees directly online. The portal usually offers various payment options. After successful payment, the system will confirm your submission. Always save or print this confirmation for your records. Keep copies of all filed documents too.

Tips for a Smooth and Error-Free Filing

Good preparation makes filing much easier. Gather all needed information and documents well before the deadline. This approach prevents rushing and mistakes.

Consider using accounting software. Many programs can help you create financial statements that meet the requirements. If you feel unsure, seek professional advice. An accountant or legal expert can guide you through the process.

Pre-Filing Checklist

Before you hit submit, do a final accuracy check. Look for common errors, like typos or wrong dates. Make sure all supporting documents are current and formatted correctly.

Confirm that all designated partners have reviewed and approved the filing. Their agreement is vital. This checklist helps catch issues before they become big problems.

Common Pitfalls to Avoid

One common mistake is using an incorrect accounting period. Always confirm the right dates for your financial year. Another pitfall is outdated partner information. Make sure all changes are recorded.

Missing signatures or proper approvals can also cause problems. Ensure all necessary parties have signed off on the document. Taking these steps helps ensure your Form 11 filing is accepted the first time.

Conclusion: Ensuring Ongoing LLP Compliance

Filing LLP Form 11 is a crucial annual duty for every Limited Liability Partnership. This article has covered the essential requirements, strict timelines, and the straightforward online procedure. Understanding these steps helps you stay compliant.

We encourage LLPs to take a forward-looking approach to their annual filings. Don't wait until the last minute. The benefits of filing on time are clear: you avoid penalties and maintain your business continuity. Always stay updated with any changes in filing rules or requirements. Your commitment to compliance helps ensure your LLP's long-term success.